Three tips to reconcile accounts payable. Supplier accounting is often confusing, but it can be even more difficult to understand if the supplier has misapplied payments or created statement credits that do not align with your intentions.

Since these accounting decisions are normally performed unilaterally by the supplier they can go unnoticed. You might not realize what has happened until it is too late and you have interruptions in shipping or services.

In this blog post, we’ll discuss why you need to reconcile accounts payable records, how suppliers might make errors, and how to audit your statements so that you don’t get hit with interruptions and/or interest charges for “late payments.

Reconcile Accounts Payable – The Basics

The accounts payable account (balance sheet) represents the exact amount of the total owed from all received and recorded invoices. Accounts payable is considered a current liability as payment is due within a year of the transaction.

When you are tasked to reconcile accounts payable you will be checking to verify that all invoices and payments are accounted for.

When you are tasked to reconcile accounts payable you will be checking to verify that all invoices and payments are accounted for.

The processes to reconcile accounts payable differs slightly from a traditional bank reconciliation as you are reconciling the amount in your accounts payable account and your vendor’s accounts receivable account.

Discrepancies often appear as vendors apply your payments against the oldest outstanding balance on account instead of against those invoices listed for payment on your remittance advice.

It is in this confusion in applying payments that errors occur and opportunities to improve your vendor relationships exist.

The “true” reconciliation of accounts payable is the reconciliation of vendor statements to your paid vendor accounts including the accounts payable account.

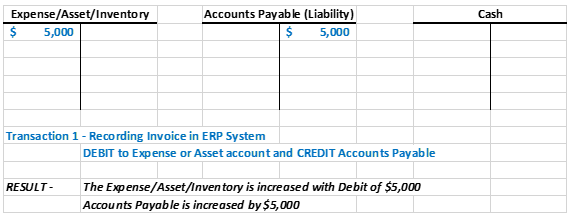

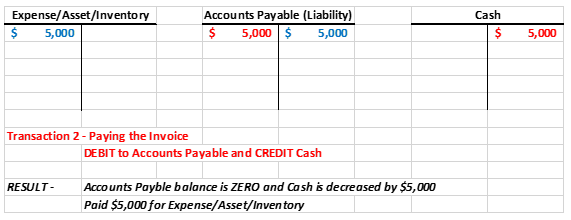

Accounts Payable Bookkeeping Basics

When you purchase an item on account, you record the entry as a credit to accounts payable and a debit to the appropriate expense, inventory, or asset account. The accounts payable account shows the money you owe, and it is considered a liability.

When you pay your invoices, your cash account (balance sheet) is credited (decreased) and the accounts payable account is debited resulting in “clearing” the AP account and “paying” for the expense/asset/inventory item.

Vendor Statements Reconciliation

Reconciliation of vendor statements is a control that provides confidence that what invoices a vendor says you owe, matches with those invoices in your ERP system and there is an agreement between you and the vendor on the amount owed.

This reconciliation should be done periodically, not less than quarterly, and can be facilitated either manually or electronically.

Here are 6 steps you should take if you want to manually reconcile your vendor statements

1) Comprehensive Outreach

You will need to reach out to all your vendors to request their statements.

2) Accuracy Check

Check that the statement you receive is accurate with what you know to be due by looking for any discrepancies in dates, amounts, and payment terms. If there are no obvious differences between your detailed list and those on the statement, then you can either pay the open invoices or reconcile all the transactions and pay suppliers as agreed upon.

If there are any credits on the vendors’ statements you could be due a refund from the supplier.

3) Review the Accounting

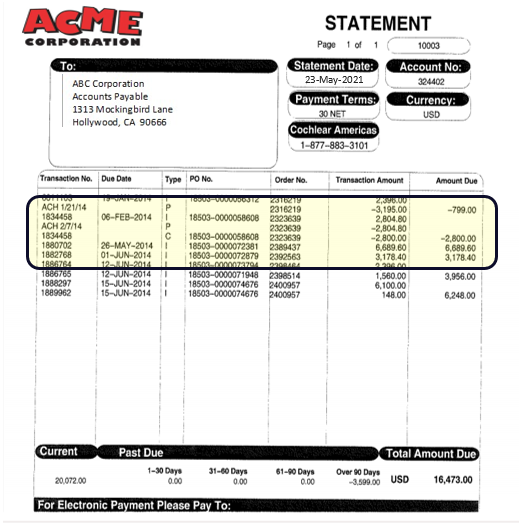

In the event that your spot check is done in step two shows items that are not known to you, the reconciliation begins. You now must compare the invoices (and other transactions) paid from your ERP system to those that appear on the vendor’s statement. This review can be done manually or electronically depending on how you received the vendor statement.

It seems that, in this case, there is an invoice on the statement that is not in your ERP system #6011103 in the amount of $2,396.00. This invoice seems to be out of phase for your account as its number doesn’t seem related to the others in your account. Everything else seems to be accounted for between the vendor’s statement and your ERP system.

4) Reconciliation

Reconcile (in this example) by contacting the vendor for clarification on the invoice that appears on the statement that is not entered into your ERP system.

Remember, If the vendor has open credits due to your company you will need to reach out and request a refund. This process is called a Vendor Statement Audit.

5) Communicate with the Supplier

When you identify line items that the supplier has misapplied you will need to connect with them directly to validate why they did it. Sometimes this step in the process is difficult because you may not have the contact information of the accounting personnel of the supplier.

When you identify line items that the supplier has misapplied you will need to connect with them directly to validate why they did it. Sometimes this step in the process is difficult because you may not have the contact information of the accounting personnel of the supplier.

6) Perform the review on a regular basis

Now that you understand the Audit process you will need to perform it on a regular basis. Depending on your company’s accounting period(s), this may be quarterly or annually, so make sure that you allocate enough time and resources for these reviews.

If you do not have the resources to perform the review you may want to reach out to an audit specialist to help you.

Conclusion

Understanding your supplier’s accounting can be a daunting task. We know that you are busy and don’t always have time to read through statements line-by-line, but if the vendor has misapplied payments or created statement credits that do not align with your intentions it could lead to costly errors down the road.

Our team of auditors would love to help out by running a statement reconciliation review for your vendors, so we can make sure there aren’t any discrepancies in their records.

Our team of auditors would love to help out by running a statement reconciliation review for your vendors, so we can make sure there aren’t any discrepancies in their records.

Let us take care of this tedious work for you! The benefits of outsourcing these tasks will save you hours every month while giving you peace of mind knowing your vendor accounts are correct and that your business receives the service level expected from your supplier partners.

One Response